This all started reading the "Miracle of Minneapolis" article in the Atlantic.

That article argued that part of the success of Minneapolis lies in both its progressive tax policies and headquarters culture. For those unfamiliar with the term headquarters culture, this quote from the article sums it up well -

“Minneapolis–St. Paul is the headquarters for 19 Fortune 500 companies—more than any other metro its size—spanning retail (Target), health care (UnitedHealth), and food (General Mills). In the past 60 years, 40 Minneapolis-based businesses have made it onto Fortune’s list. “We’re not like Atlanta, where half of its Fortune 500s moved there,” Myles Shaver, a professor at the Carlson School of Management at the University of Minnesota, told me. “There is something about Minneapolis that makes us unusually good at building and keeping large companies.”

Shaver’s theory, which he’s developing into a book, is that Minneapolis is so successful at turning medium-size companies into giants because its most important resource never leaves the city: educated managers of every level, who can work at just about any company. Shaver looked at the outward migration of employed, college-educated people who earn at least twice the national average income—his proxy for the manager demographic—and found that of the 25 largest American cities, only one had a lower rate of outflow than Minneapolis (although he couldn’t compute data for three others). Among all college-educated workers, Minneapolis also had the second-lowest outflow. “It bears out the old adage: ‘It’s really hard to get people to move to Minneapolis, and it’s impossible to get them to leave. ”

Minnesota has the tenth-most Fortune 500s in the nation.

By metropolitan area, Minneapolis-St. Paul ranks first among the 30 largest metropolitan areas in the number of Fortune 500 companies per capita.

But what happens when we move into an economy where "educated managers" may not be as valuable as they once were?

Technology is drastically changing the nature of business and knowledge work. Business models and organizations (no matter how large) are now ripe for "disruption". Technology is a catalyst to dethroning legacy organizations.

Here are a couple of quotes / charts that have been making the rounds -

So knowing that technology is changing the nature of business, I started to wonder (because why not) if these lauded behemoths in the Twin Cities economy are poised to win in the future, where an organization's willingness to adapt to change might be their greatest (and only) competitive advantage.

With so many large Minnesota companies structured to support 20th century knowledge work, how can we assess if these large companies are ready to succeed in today's economy?

I think Undercurrent's tenants of a responsive organization is a good starting point to understand an organization's ability to adapt to change:

“Today’s fastest growing, most profoundly impactful companies are using a completely different operating model. These companies are lean, mean, learning machines. They have an intense bias to action and a tolerance for risk, expressed through frequent experimentation and relentless product iteration. They hack together products and services, test them, and improve them, while their legacy competition edits PowerPoint. They are obsessed with company culture and top tier talent, with an emphasis on employees that can imagine, build, and test their own ideas. They are maniacally focused on customers. They are hypersensitive to friction – in their daily operations and their user experience. They are open, connected, and build with and for their community of users and co-conspirators. They are comfortable with the unknown – business models and customer value are revealed over time. They are driven by a purpose greater than profit; each has its own aspirational “dent in the universe.” We may simply refer to them as the first generation of truly responsive organizations.”

While this might be a bit of hyperbole, it's hard to argue with their core tenants of what makes a responsive organization -

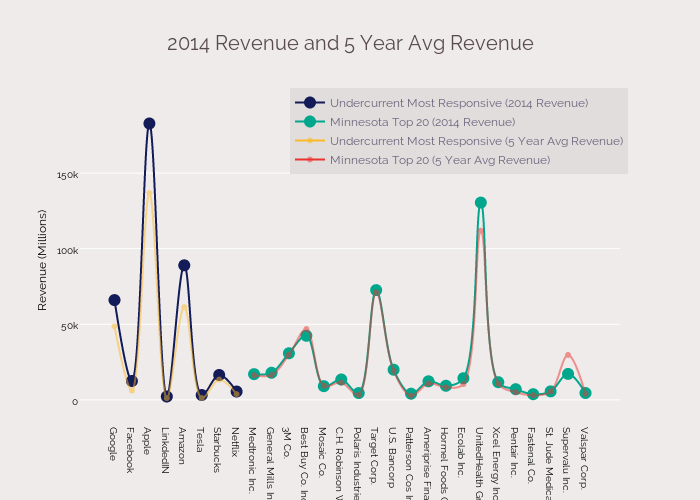

I decided to use Undercurrent's framework to answer a few questions about the top 20 publicly traded Minnesota companies (by 2014 revenue).

Method -

Company Selection:

Picked the 20 Minnesota publicly traded companies with the highest revenue in 2014.

Picked the 7 publicly traded companies on the Undercurrent "most responsive companies" list.

Questions I attempted to answer:

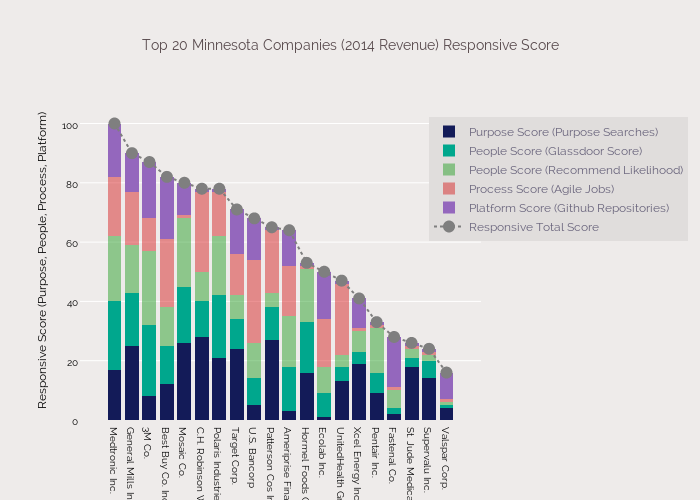

1) Which of these 20 top revenue driving Minnesota companies are the most responsive?

2) How do these companies compare to the 7 publicly traded companies on Undercurrent's most responsive list?

3) Do measures of responsiveness correlate with or predict income, revenue, or earnings per share? For Minnesota companies? For the 7 publicly traded Undercurrent ones?

How responsiveness was compared -

(adapted from here ):

Purpose - measured by the percentage of search results for purpose rather than profitability following the company name

Process - measured by the % of open job descriptions on indeed.com that included the word agile or agility

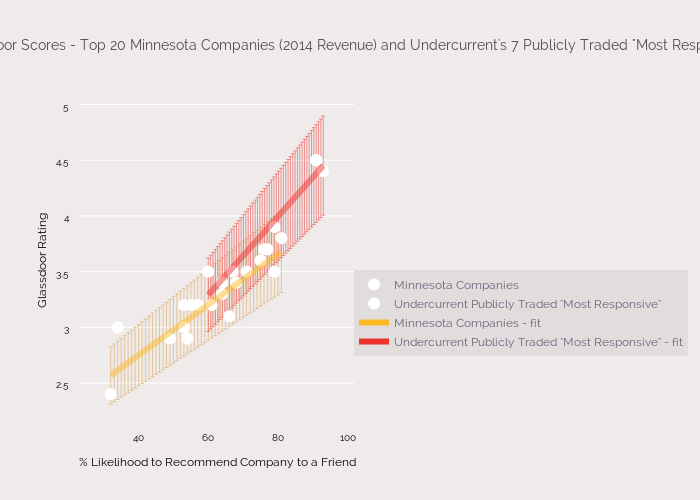

People - measured by Glassdoor scores and likelihood to recommend the workplace to a friend.

Platforms - Number of Github repositories where users were utilizing a company's product or public API

As you can see I did not include product, but that could definitely be added with more time and information.

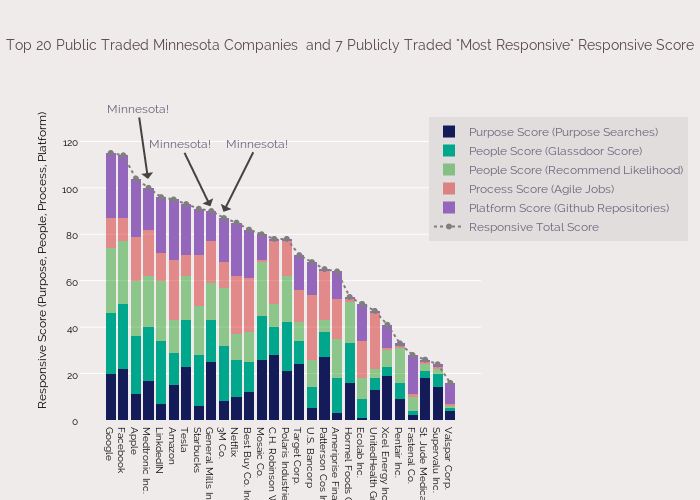

1) Which of these 20 top revenue driving Minnesota companies are the most responsive?

2) How do these companies compare to the 7 publicly traded companies on Undercurrent's most responsive list?

There were 3 Minnesota companies" Medtronic, General Mills, and 3M that outperformed the responsive 7 in terms of total responsive points.

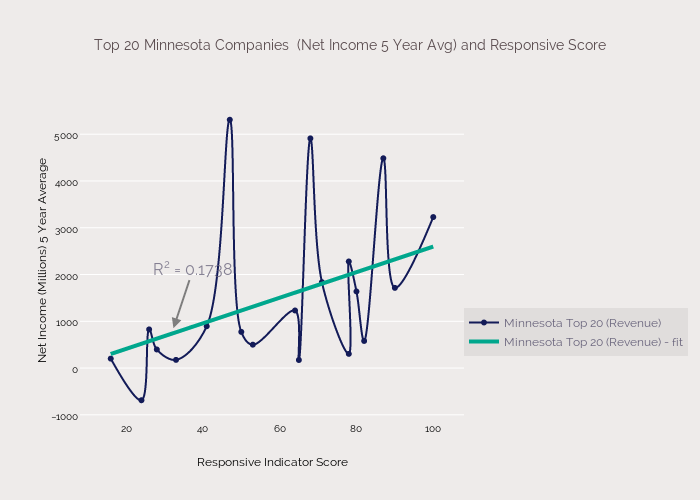

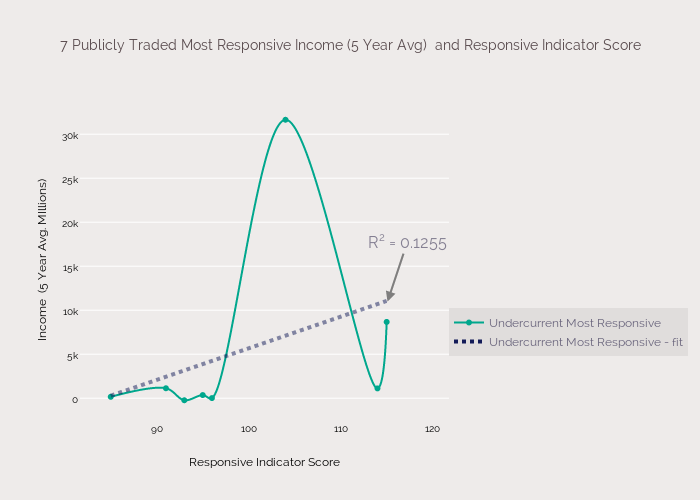

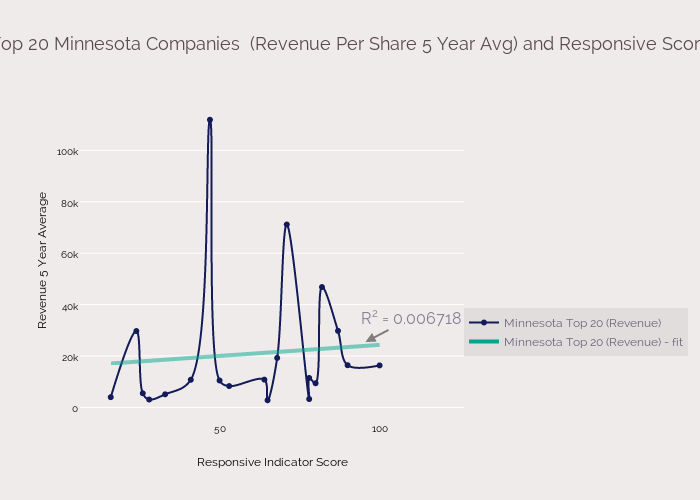

3) Do measures of responsiveness correlate with or predict Income, revenue, or Earnings Per share over the last five years?

INCOME

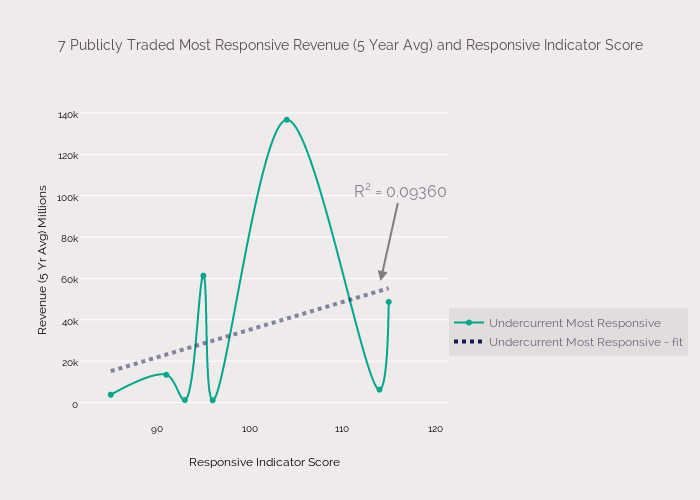

Revenue

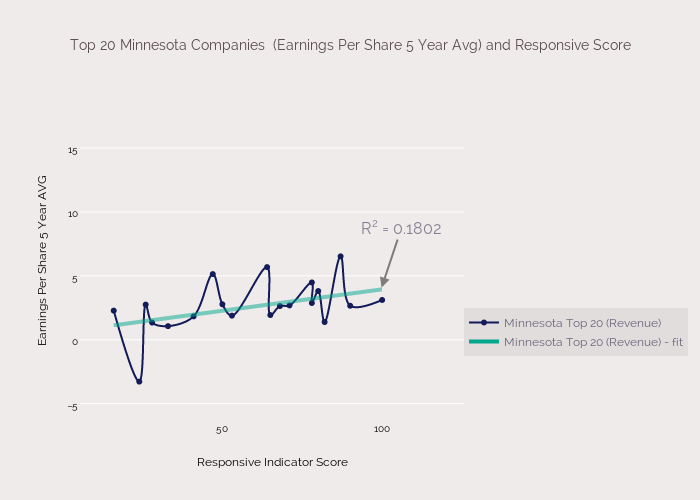

Earnings Per Share

Implications -

- For companies both on the Undercurrent list and the Minnesota top 20 revenue list, being more responsive is mildly predictive of 5 year average income.

- For Minnesota top 20, being more responsive is also mildly predictive of earnings per share (5 year avg), but I have a hunch this might be just because of the increasing allocation of income to stock at places like UHG?

- 3 companies on the Minnesota top 20 had responsive scores high enough to be in line with the 7 publicly traded companies on Undercurrent's most responsive list (Medtronic, General Mills, 3M)

An Area for Improvement-

- One of the starkest differences between the Minnesota Top 20 and the Undercurrent 7 was in their Glassdoor scores, both in terms of overall star rating and likelihood to recommend the workplace to a friend.

Summary and what's next -

It seems that there is a relationship with being more responsive and income over the last five years for both groups. Medtronic, 3M and General Mills are Minnesota companies that do well on these indicators of responsiveness, they are even in line with some of the new tech giants on the list!

The dream of Minneapolis may still be alive after all, with companies like 3M, Medtroic and General Mills working hard to innovate in their respective areas and attract top talent. Or maybe that is just my Minnesota bias shining through.